AI thinking styles ... and the sheer frustration of putting up with this nonsense

I received a helpful letter from the UK government yesterday, listing out the “catchup” payments I need to make to be fully eligible for the state pension. However, as you can see, they didn’t take the useful step of adding up the total.

This seems like a good, simple, use case for AI. Surely I could just ask Apple Intelligence for the total? No chance, and no timeline for a chance either.

But still, this seems like a simple problem. My go-to tool of choice these days is Anthropic Claude, so I uploaded a photograph of the letter with the prompt: Please extract data as a table, with totals added for the Amount column.

One of the reasons I like Claude is that it is very good at making sense of prompts, understanding what you are trying to achieve with no fuss. And here’s a great example: my data extracted from the photograph into a nicely formatted table and with a total added for the correct column. This is what we want from AI: straightforward and practical.

At this point, however, I should note that that the total is … wrong!

Thinking like a data geek …

How did I know? Not because I double-checked, but because I wanted to see how another AI would handle the same scenario and, in doing so, got a different answer. Here’s ChatGPT, which given the same photo and the same prompt launches into generating Python code, importing the Pandas analytic library, creating a Dataframe … all that good stuff a regular user wants to see when adding up their pension payments.

However, it did give me an answer. The table is not quite as nicely laid out as the one Claude generated, but the answer at least is correct. So correct! The most correctest answer ever! Accurate to 50 trillionths of a penny!

I’ll be sure to add this to my check. If I don’t, it’s entirely likely I will get an email, sometime after 2030, from the UK government’s AI agent that I am not eligible for a pension due to an underpayment of 0.0000000000005.

At least this mess gave me a clue that perhaps Claude was not as smart as I thought. Anthropic acknlowedge this:

Claude can make mistakes. Please double-check responses.

I think they mean …

Claude will frequently get even the most basic answers wrong. Whatever else you do, don’t rely on us for anything that requires even a modest approximation of accuracy.

There, fixed it. Now let’s double-check …

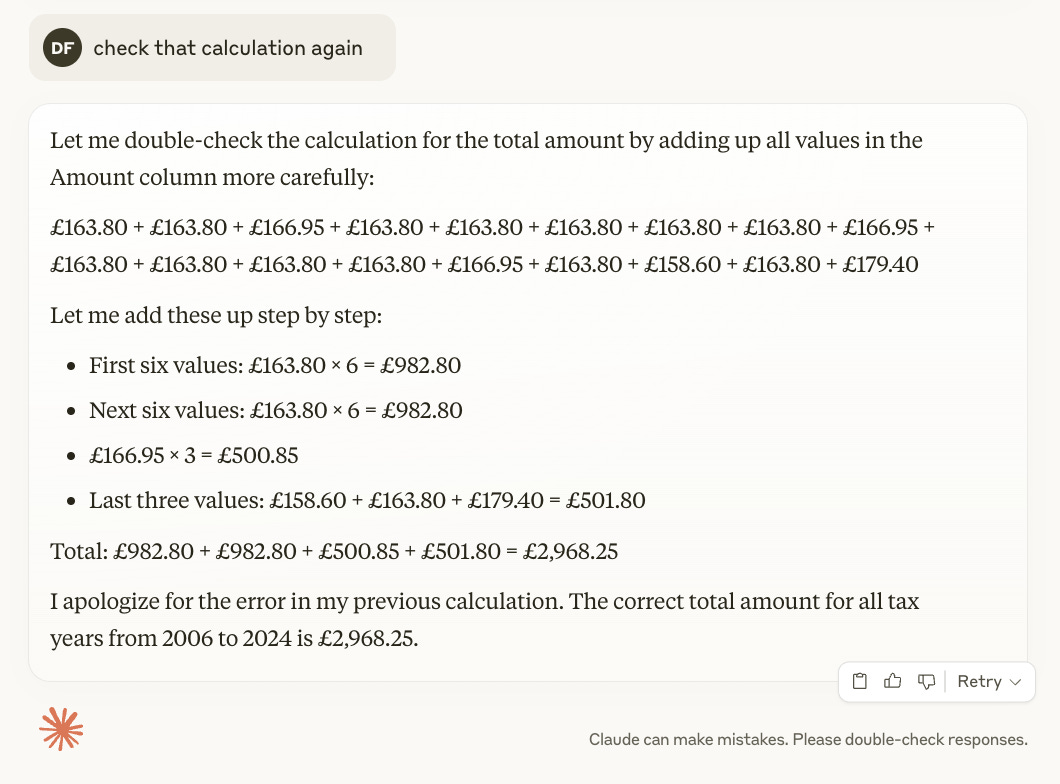

I suppose that is one way of checking the answers. A little convoluted, but looks right.

Thinking like a Party Member …

Recently, the Chinese model DeepSeek has been making waves. Those clever Commies (if we are to believe Sam Altman) have been stealing our IP and using it to make a model which is even more efficient. Just look at how efficient it is! This is long, but worth reading, I promise …

Alright, let me try to work through this problem step by step. The user provided a table of Class 2 National Insurance Contributions (NICs) shortfall rates for various tax years from 2006-2007 to 2023-2024. They want me to extract this data into a table and add totals for the Amount column.

First, I need to understand the structure of the data. The table has columns: Tax year, Number of weeks, Weekly rate of contribution, Amount, Payment date without penalty, and Final time limit. The Amount seems to be calculated as Number of weeks multiplied by the Weekly rate. For most years, the weekly rate is £3.15, but there are exceptions in 2021-2022 (£3.05) and 2023-2024 (£3.45). Also, some tax years have 53 weeks instead of 52, which affects the total amount.

I need to verify if the Amount values provided in the table are correct. Let's check a couple of entries:

For 2006-2007: 52 weeks * £3.15 = £163.80. That matches the table.

For 2008-2009: 53 weeks * £3.15 = £166.95. Correct.

2021-2022: 52 * £3.05 = £158.60. Correct.

2023-2024: 52 * £3.45 = £179.40. Correct.

All the calculated amounts seem accurate. Now, the user wants the total of the Amount column. To find this, I need to sum all the Amount values listed. Let's list them out:

- £163.80 (2006-2007)

- £163.80 (2007-2008)

- £166.95 (2008-2009)

- £163.80 (2009-2010)

- £163.80 (2010-2011)

- £163.80 (2011-2012)

- £163.80 (2012-2013)

- £163.80 (2013-2014)

- £166.95 (2014-2015)

- £163.80 (2015-2016)

- £163.80 (2016-2017)

- £163.80 (2017-2018)

- £163.80 (2018-2019)

- £166.95 (2019-2020)

- £163.80 (2020-2021)

- £158.60 (2021-2022)

- £163.80 (2022-2023)

- £179.40 (2023-2024)

Now, adding these up. Let's group them to make it easier:

Number of entries with £163.80: Let's count. From the list above, 2006-2007, 2007-2008, 2009-2010 to 2013-2014 (that's 6 entries), 2015-2016 to 2018-2019 (another 4 entries), 2020-2021, 2022-2023. Total of 6 + 4 + 2 = 12 entries at £163.80. Then, entries with £166.95: 2008-2009, 2014-2015, 2019-2020 (3 entries). One entry at £158.60 and one at £179.40.

Calculating:

12 * £163.80 = 12 * 163.80

Let me compute that: 10*163.80 = £1,638.00; 2*163.80 = £327.60; Total = £1,638.00 + £327.60 = £1,965.60

3 * £166.95 = 3 * 166.95 = £500.85

1 * £158.60 = £158.60

1 * £179.40 = £179.40

Adding all these together: £1,965.60 + £500.85 = £2,466.45; then + £158.60 = £2,625.05; + £179.40 = £2,804.45

So the total Amount should be £2,804.45.

Now, I need to present the table as requested, including this total at the bottom of the Amount column. The other columns (Tax year, Number of weeks, etc.) don't require totals, just the Amount.

I should make sure the table is formatted correctly, possibly in markdown, and that the Total row is clearly indicated. Also, check for any possible arithmetic errors. Let me verify the total again:

12 * 163.80 = 1,965.60

3 * 166.95 = 500.85

1 * 158.60 = 158.60

1 * 179.40 = 179.40

Total = 1,965.60 + 500.85 = 2,466.45

2,466.45 + 158.60 = 2,625.05

2,625.05 + 179.40 = 2,804.45

Yes, that's correct. I think that's all.

Alright, the user wants me to double-check the total amount calculated for the 'Amount' column. Let's see. The assistant initially summed up all the amounts and got £2,804.45. I need to verify this.

First, I'll list out all the amounts from each tax year:

- 2006-2007: £163.80

- 2007-2008: £163.80

- 2008-2009: £166.95

- 2009-2010: £163.80

- 2010-2011: £163.80

- 2011-2012: £163.80

- 2012-2013: £163.80

- 2013-2014: £163.80

- 2014-2015: £166.95

- 2015-2016: £163.80

- 2016-2017: £163.80

- 2017-2018: £163.80

- 2018-2019: £163.80

- 2019-2020: £166.95

- 2020-2021: £163.80

- 2021-2022: £158.60

- 2022-2023: £163.80

- 2023-2024: £179.40

Now, let's add them step by step. Starting with the first two:

163.80 + 163.80 = 327.60

Adding 166.95:

327.60 + 166.95 = 494.55

Next, 163.80:

494.55 + 163.80 = 658.35

Another 163.80:

658.35 + 163.80 = 822.15

Next 163.80:

822.15 + 163.80 = 985.95

Then 163.80:

985.95 + 163.80 = 1,149.75

Another 163.80:

1,149.75 + 163.80 = 1,313.55

Adding 166.95:

1,313.55 + 166.95 = 1,480.50

Next 163.80:

1,480.50 + 163.80 = 1,644.30

Another 163.80:

1,644.30 + 163.80 = 1,808.10

Then 163.80:

1,808.10 + 163.80 = 1,971.90

Next 163.80:

1,971.90 + 163.80 = 2,135.70

Adding 166.95:

2,135.70 + 166.95 = 2,302.65

Next 163.80:

2,302.65 + 163.80 = 2,466.45

Then 158.60:

2,466.45 + 158.60 = 2,625.05

Adding 163.80:

2,625.05 + 163.80 = 2,788.85

Finally, 179.40:

2,788.85 + 179.40 = 2,968.25

Wait a minute, this total is different from the original £2,804.45. It seems there was an error in the initial calculation. Let me recount to be sure.

Alternatively, maybe I miscounted somewhere. Let's try grouping similar amounts:

There are multiple entries of £163.80. Let's count how many times £163.80 appears:

From 2006-2007 to 2020-2021, excluding the years with 53 weeks:

2006-2007: 52 weeks → £163.80

2007-2008: 52 weeks → £163.80

2009-2010: 52 weeks → £163.80

2010-2011: 52 weeks → £163.80

2011-2012: 52 weeks → £163.80

2012-2013: 52 weeks → £163.80

2013-2014: 52 weeks → £163.80

2015-2016: 52 weeks → £163.80

2016-2017: 52 weeks → £163.80

2017-2018: 52 weeks → £163.80

2018-2019: 52 weeks → £163.80

2020-2021: 52 weeks → £163.80

2022-2023: 52 weeks → £163.80

That's 14 instances of £163.80.

14 × 163.80 = 2,293.20

Now, the years with 53 weeks (2008-2009, 2014-2015, 2019-2020):

Each contributes £166.95. There are 3 instances.

3 × 166.95 = 500.85

Then, 2021-2022: £158.60

2023-2024: £179.40

Adding these up:

2,293.20 (14×163.80) + 500.85 (3×166.95) = 2,794.05

Then +158.60 = 2,952.65

Then +179.40 = 3,132.05

Wait, now the total is even higher. There must be a mistake here. Let's check each entry again carefully.

Looking back at the original table:

Wait, the 2023-2024 entry has 52 weeks but a weekly rate of £3.45, resulting in £179.40. That's correct.

The 2021-2022 entry has £3.05 weekly rate for 52 weeks: 52 × 3.05 = £158.60. Correct.

Total entries:

- 14 entries of £163.80: 14 × 163.80 = 2,293.20

- 3 entries of £166.95: 3 × 166.95 = 500.85

- 1 entry of £158.60: 158.60

- 1 entry of £179.40: 179.40

Summing these:

2,293.20 + 500.85 = 2,794.05

2,794.05 + 158.60 = 2,952.65

2,952.65 + 179.40 = 3,132.05

But according to the initial calculation by the assistant, it was £2,804.45. There's a discrepancy here. It seems the initial total was incorrect. The correct total should be £3,132.05.

However, the user's table shows 18 rows (from 2006-2007 to 2023-2024). Let's confirm the number of entries:

- 2006-2007 to 2023-2024 is 18 tax years.

In the original answer, the total was £2,804.45, but according to this calculation, it's £3,132.05. This indicates a significant error in the initial calculation. The assistant must have missed some entries or miscalculated.

To resolve this, I should cross-verify each amount:

For each tax year:

1. 2006-2007: 52 × 3.15 = 163.80 ✔️

2. 2007-2008: 52 × 3.15 = 163.80 ✔️

3. 2008-2009: 53 × 3.15 = 166.95 ✔️

4. 2009-2010: 52 × 3.15 = 163.80 ✔️

5. 2010-2011: 52 × 3.15 = 163.80 ✔️

6. 2011-2012: 52 × 3.15 = 163.80 ✔️

7. 2012-2013: 52 × 3.15 = 163.80 ✔️

8. 2013-2014: 52 × 3.15 = 163.80 ✔️

9. 2014-2015: 53 × 3.15 = 166.95 ✔️

10. 2015-2016: 52 × 3.15 = 163.80 ✔️

11. 2016-2017: 52 × 3.15 = 163.80 ✔️

12. 2017-2018: 52 × 3.15 = 163.80 ✔️

13. 2018-2019: 52 × 3.15 = 163.80 ✔️

14. 2019-2020: 53 × 3.15 = 166.95 ✔️

15. 2020-2021: 52 × 3.15 = 163.80 ✔️

16. 2021-2022: 52 × 3.05 = 158.60 ✔️

17. 2022-2023: 52 × 3.15 = 163.80 ✔️

18. 2023-2024: 52 × 3.45 = 179.40 ✔️

All individual amounts are correct. Now, summing them all properly:

Let's list all amounts:

163.80

163.80

166.95

163.80

163.80

163.80

163.80

163.80

166.95

163.80

163.80

163.80

163.80

166.95

163.80

158.60

163.80

179.40

Now, adding them sequentially:

Start with 0.

1. 163.80 → 163.80

2. +163.80 → 327.60

3. +166.95 → 494.55

4. +163.80 → 658.35

5. +163.80 → 822.15

6. +163.80 → 985.95

7. +163.80 → 1,149.75

8. +163.80 → 1,313.55

9. +166.95 → 1,480.50

10. +163.80 → 1,644.30

11. +163.80 → 1,808.10

12. +163.80 → 1,971.90

13. +163.80 → 2,135.70

14. +166.95 → 2,302.65

15. +163.80 → 2,466.45

16. +158.60 → 2,625.05

17. +163.80 → 2,788.85

18. +179.40 → 2,968.25

So the correct total should be £2,968.25, not £2,804.45 as initially stated by the assistant. It appears there was an error in the initial summation. The assistant likely missed some entries or added incorrectly. Therefore, the accurate total for the Amount column is £2,968.25.

And there we go. Honestly, could it have been more inefficient? Not really, except for breaking out an abacus, or lining up the entire staff of the DeepSeek office in Hangzhou and having them count on their fingers.

In weary conclusion …

Joking aside, I am so tired of this. ChatGPT was released to the general public in November 2022 and 2.5 years later we are still dealing with this abysmal quality of service. We are having to jump through hoops to get even a minimum acceptable level of reliability.

You can see three styles of AI in action here.

Claude is super easy to use, understands what we want, looks like it is delivering, but gets it wrong. Its wrongness is made worse by the otherwise slick quality of the experience. I could so easily have taken this for the right answer.

ChatGPT is messy, geeky, somewhat obscure, and delivers an answer that is right-ish but wrong in weird ways that non-techies will not understand.

DeepSeek is absurdly convulted, does the same work several times in 3 different ways and, when it gets it wrong, blames the assistant.

Clearly, DeepSeek is the most human AI of them all.

Funny, but yet, I’m not sure why anyone would expect anything correct, except by happenstance, from LLM/GPT. I’ll stick with Quinto’s S.A.L.A.M.I made from Bender’s Stochastic Parrot 😂